Its bookkeeping service comes with its Enterprise plan, which costs $399 per month when billed annually. You’ll get accounting for startups: the ultimate guide a dedicated accountant, year-round tax advice, tax prep, bookkeeping and financial reports. Live Expert Full-Service Bookkeeping doesn’t include sending invoices, paying bills, or management of inventory, accounts receivable, or accounts payable. The service doesn’t include financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll. QuickBooks Online offers Expert Full Service Payroll for an additional cost.

- You can also book a call with your bookkeeper (or send them a message) whenever you’d like.

- You’ll be able to see your experts’ specific credentials and experience, so you’ll know you’re in good hands with America’s #1 tax prep provider.

- Online bookkeeping services can save business owners both time and money.

- You’re never too small, and it’s never too soon to know you’re on track for success.

- After you sign up to Bench, a member of our bookkeeping team will assist you in connecting all your financial accounts securely to our platform.

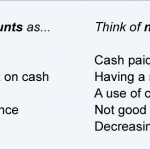

The best accounting software automates a lot of the process in journal entries for regular debits and credits to help eliminate possible errors in data entry. Bookkeeping is the process of tracking income and expenses in your business. It lets you know how you’re doing with cash flow and how your business is doing overall.

Talk to sales

Our expertise spans across entities operating under different tax regimes, including the single tax system, the common taxation system, and those dealing with Value Added Tax (VAT). Our expertise extends to managing the financial aspects of non-profit organizations, including charitable foundations and public organizations. Sunrise, by Lendio, used to be called Billy until it was acquired. It’s known for its easy-to-use interface and its simplification of accounting jargon.

We handle these reporting requirements with precision and timeliness, ensuring that all financial data is accurately documented and submitted to the relevant authorities. This includes the preparation and submission of necessary reports to maintain your non-profit status and demonstrate transparency to stakeholders. At “Accounting outsourcing services” we extend our specialized accounting services to non-profit organizations, including charitable foundations and public organizations. Look at the item in question and determine what account it belongs to. For example, when money comes from a sale, it will credit the sales revenue account.

After you sign up to Bench, a member of our bookkeeping team will assist you in connecting all your financial accounts securely to our platform. This enables you and your Bench team to work together seamlessly from the start. If you want your business to save time and money, then you should consider hiring a bookkeeping service.

CONSULTATIONS ON FINANCIAL ACCOUNTING ISSUES AND IFRS CONSULTING

If your monthly average is $0-10,000 per month, the monthly price for QuickBooks Live Expert Full-Service Bookkeeping is $300. Cleanup typically takes 30 days once you upload your required docs. Connect one-on-one with experts so you can manage your books with ease. The most common mistakes are mixing personal and business finances, leaving taxes to the last minute, missing out on deductions, and not retaining records for long enough. We can fully wipe your data, too—at the end of the day, it’s your info and your call.

Next up in Business

Our ratings considered everything from pricing and customer reviews to the number and quality of features available and what our panel of experts thought about the services available. Live Expert Assisted doesn’t include cleanup of your books or a dedicated bookkeeper reconciling your accounts and maintaining your books for you. Live Expert Assisted also doesn’t include any financial advisory services, tax accounts receivable and accounts payable advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll.

Are bookkeeping and accounting different?

We are your trusted partner in navigating the financial complexities, allowing you to thrive in your chosen field and focus on what you do best. In the fast-paced field of IT, we offer specialized accounting services that recognize the unique challenges and opportunities within this sector. Our team helps you manage project-based revenue, R&D expenses, and the intricacies of IT-related taxation, allowing you to innovate and departments to manage the purchasing grow.

Bookkeeper360 integrates with third-party tools, such as Bill, Gusto, Stripe, Shopify, Xero, Brex, Square, Divvy and ADP. These integrations make it easy to track your bookkeeping and accounting data in one place. It also offers full-service bookkeeping, meaning that its team will do the bookkeeping for you.

For entrepreneurs involved in foreign economic activity, we provide comprehensive support in dealing with international transactions, currency exchange, import/export regulations, and tax considerations. Our expertise ensures that your business expands seamlessly across borders while maintaining financial accuracy and compliance. At “Accounting outsourcing services” we proudly serve a diverse clientele of small entrepreneurs engaged in a wide range of activities. Once the entries are assigned to the correct accounts, you can post them to the general ledger to get a bird’s-eye view of your current cash status. Most accounting software does this for you, so you don’t need to worry about an extra step. Another type of accounting method is the accrual-based accounting method.